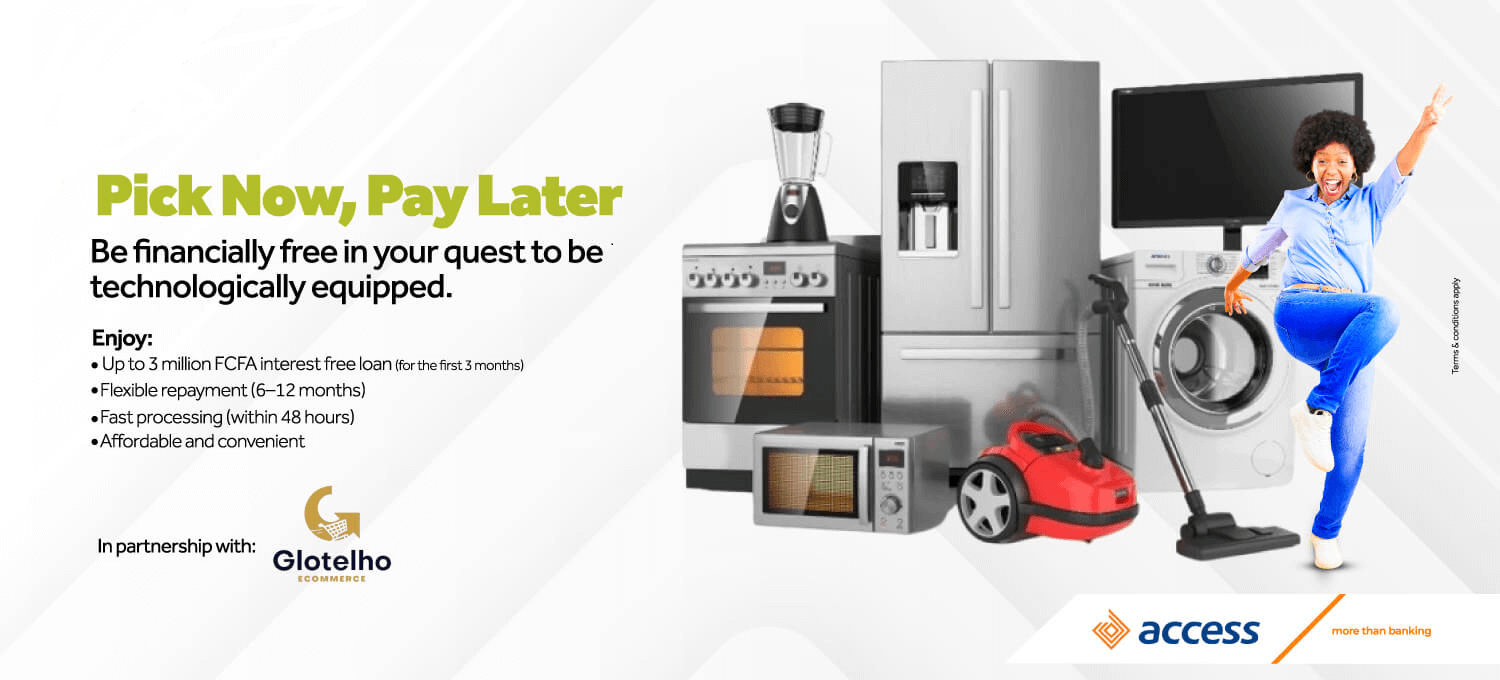

Pick Now Pay Later

This account is SPECIFICALLY for REGISTERED Non-Government and Profits

Organizations(Clubs, Societies, Associations, Churches) who want to enjoy our Banking

services.

PLEASE NOTE: Only CAC confers registration on all organisations.

Upgrade Your Home Today, No Upfront Payment. Flexible Salary-Backed Instalments Available. Start enjoying premium electronics and furniture with Pick Now Pay Later (PNPL).

Pick Now Pay Later (PNPL) is an innovative lifestyle financing solution offered by Access Bank Cameroon. It allows eligible customers to buy electronics and furniture immediately, while paying later through convenient salary-backed instalments.

This product makes it easy to improve your comfort and modernise your home without financial stress.

Talk to us about how we could support your business, please CONTACT us on:

You can also call our Numbers:

Telephone: +237 655 55 00 22

WhatsApp: +237 679 20 06 83

Email : contactcentercm@accessbankplc.com

Latest News